Most of the businesses in this industry dealing in international import shipping pay close attention to logistics, packaging, and delivery times, among others. However, one usually overlooked aspect is something very important: duties and taxes. These will be major variables that determine your overall import costs and can even dictate how competitive your pricing will be in foreign markets.

Now, let’s break it down in simple terms.

What are Duties and Taxes?

Duties are government charges imposed on imported goods; charges are usually based on product type, value, and country of origin.

The taxes will be imposed by the country of destination over and above the value of the product and its duties, which could be in the form of VAT or GST.

When added together, these become the landed cost: the total cost of getting a product from one country to another.

Why Duties and Taxes Matter in International Import Shipping

When you’re managing international import shipping, understanding duties and taxes means:

- Pricing clarity and transparency to customers

- Smooth customs clearance

- No hidden costs and no delays in delivery.

Failure to handle the obligations correctly might lead to unexpected charges, holds on shipment, or even penalties from customs authorities.

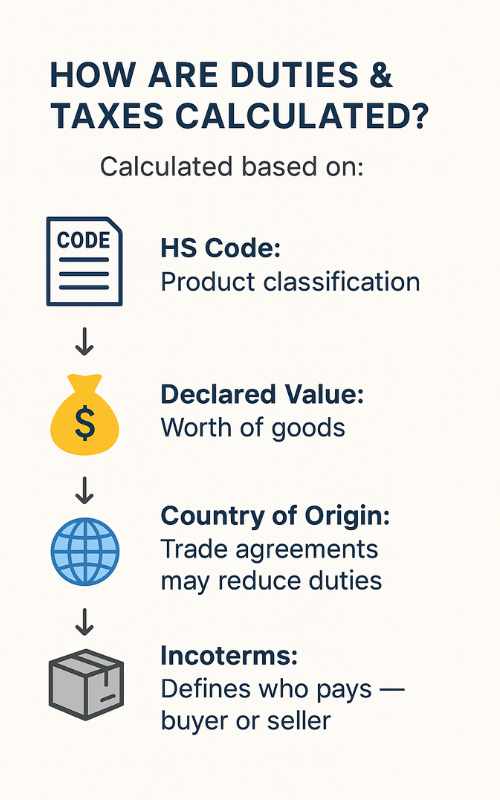

How Are Duties and Taxes Calculated?

While the rates vary depending on country, duties and taxes are most often determined by:

- HS Code: Harmonized System Code, which indicates the classification of products.

- Declared Value: The total value of goods for customs purposes.

- Country of Origin: Some trade agreements can reduce or remove duties.

- Incoterms (Shipping Terms): Indicates whether it is the buyer or seller who pays for duties and taxes.

As you can see, under DDP, customs charges are taken care of by the seller, while in DAP, this responsibility lies with the buyer upon arrival.

Who pays the duties, the seller or the buyer?

That depends on the choice of Incoterm in international import shipping.

- DDP: A delivery where the seller bears the duties and taxes.

- DAP/DDU (Delivered at Place/Unpaid): The buyer pays duties and taxes upon arrival.

Using the right term can help you in pricing strategy and customer satisfaction.

How to Simplify the Process

To avoid confusion and extra costs, many international businesses collaborate with logistics experts or Importer of Record service providers, taking care of:

- Duty and tax calculation

- Customs paperwork

- Regulatory compliance

It ensures that your international import shipping is smooth, compliant, and cost-effective.

Final Thoughts

Success in international import shipping requires an understanding of duties and taxes. With a proper plan in place and experienced logistics partners by your side, you avoid costly surprises, fast-track customs clearance, and deliver a seamless global shipping experience for your customers.