Introduction

If you decide to expand your business across borders, shipping internationally becomes the key to reaching new customers across the globe. However, besides logistical and delivery issues, one of the important and confusing aspects for both sellers and buyers is duties and taxes. Understanding these costs helps you set clear expectations, avoid customs delays, and ensure smooth delivery.

What Are Duties and Taxes?

When goods are shipped from one country to another, governments impose duties and taxes on imports to regulate trade and protect local industries.

- Duties are tariffs charged based on the product type and its value.

- Taxes are additional charges coming from the destination country, such as VAT or GST.

Put together, they comprise the landed cost: the price your customer actually pays to take delivery of the product.

Why Duties and Taxes Matter in International Shipping

Ignoring or underestimating these charges leads to:

✅Customers will experience unexpected expenses.

✅Shipment delays at customs

✅ Risk of package returns or confiscation

Indeed, by calculating duties and taxes in advance, businesses can offer transparent pricing and gain trust from international buyers.

How Duties and Taxes Are Calculated

The amount you pay depends on several factors:

- Product classification (HS Code): Determines the duty rate for your item.

- Declared value: The total cost of the goods, plus insurance and freight.

- Country of origin: Some trade agreements reduce or eliminate duties.

- Destination country regulations: Every country has its own tax policies.

The complications with customs duty calculation or estimating customs duty can be minimized with the use of an international shipping calculator or customs duty estimator.

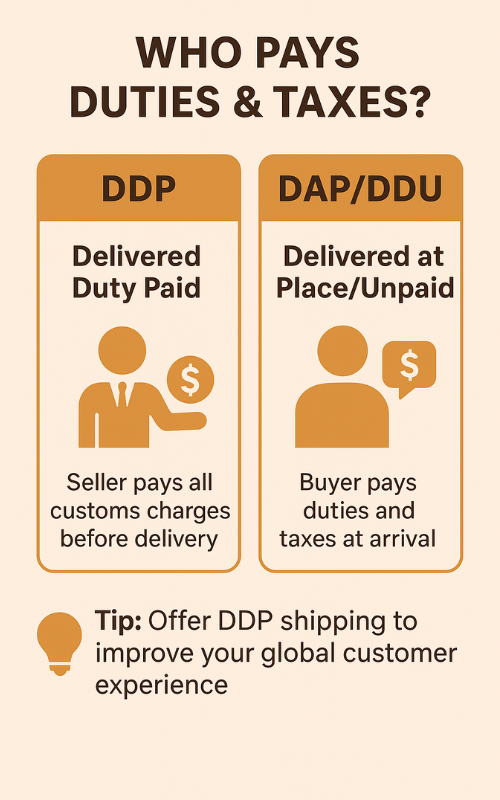

Who Pays Duties and Taxes?

Depending on your shipping terms, that is, Incoterms, either the seller or the buyer is responsible for:

- DDP: Delivered Duty Paid means that the seller pays all customs charges before delivery.

- DAP/DDU (Delivered at Place/Unpaid): The buyer pays the duties and taxes upon arrival.

DDP shipping improves the customer experience for e-commerce sellers by eliminating surprise costs.

Tips to Simplify Duties and Taxes Management

✔️ Use the right HS codes for each product

✔️Clearly state all costs in your invoices

✔️Partner with a seasoned logistics partner

✔️ Offer DDP shipping for a hassle-free customer journey

You can make international shipping efficient, predictable, and customer-friendly by proactively managing duties and taxes.

Conclusion

International shipping doesn’t have to be complicated. When you understand how duties and taxes work, you gain control over your shipping costs, reduce customs delays, and deliver a better experience to your global customers. Simplify your cross-border logistics with a partner you can rely on for everything, from customs clearance to final delivery.